What is NREGA Aadhaar-based payment system?

After 31 December 2023, all workers seeking employment under the Centre’s National Rural Employment Guarantee Act (NREGA) will be required to transition to the Aadhaar-based Payment Bridge System (ABPS) for receiving their wages. This shift marks the end of the current dual-payment system, under which NREGA workers have the option to receive their wages either through an account-based system or the Aadhaar-based system. Until this deadline, workers can continue to choose between the two modes of payment.

However, from 2024 onward, the ABPS will become mandatory, aligning with the government’s push for digital transparency and streamlined financial disbursement. This move aims to reduce instances of wage fraud and delays in payment while ensuring that wages are directly credited into workers’ Aadhaar-linked bank accounts, enhancing efficiency and accountability in wage disbursement under the NREGA scheme. Workers who are not enrolled in the ABPS by the deadline may face disruptions in receiving their wages until they complete the required process. Therefore, it is crucial for workers to ensure their Aadhaar is linked to their bank accounts well before the cut-off date.

The Ministry of Rural Development had initially directed state governments to ensure that all payments to beneficiaries under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) be processed exclusively through the Aadhaar-based Payment System (ABPS) starting February 1, 2023. However, this deadline has been extended multiple times due to various challenges in implementation across states.

It is important to clarify that MGNREGA has adopted the Aadhaar-based Payment Bridge System (ABPS), not the Aadhaar-enabled Payment System (AePS). While AePS allows for cash withdrawals and other banking services through Aadhaar authentication, ABPS is specifically designed for transferring payments directly into bank accounts linked with Aadhaar. This distinction is significant in understanding how beneficiaries receive their wages.

In addition to the payment system changes, the government introduced a new measure for ensuring worker attendance under MGNREGA. From January 1, 2023, attendance tracking is mandated to be done through the National Mobile Monitoring System (NMMS) app. This mobile-based application requires supervisors to upload geo-tagged, time-stamped photographs of workers at the job site, aimed at enhancing transparency and accountability in the implementation of the scheme. While intended to curb delays and leakages in the payment process, both the ABPS and NMMS systems have faced logistical challenges, particularly in remote areas with limited internet connectivity or insufficient Aadhaar linkage.

What is Aadhaar-based bridge payment system (ABPS)?

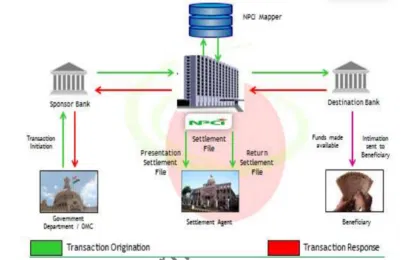

The Aadhaar Payments Bridge System (APBS), as defined by the National Payments Corporation of India (NPCI), is a specialized payment platform that leverages an individual’s Aadhaar number as a central identifier to seamlessly route government subsidies and welfare benefits directly into their Aadhaar-Enabled Bank Account (AEBA). This system is designed to enhance transparency, reduce fraud, and ensure timely disbursement of funds by eliminating intermediaries.

For a NREGA (National Rural Employment Guarantee Act) job card holder to access the benefits through APBS, they must link their bank account with their Aadhaar number. Furthermore, the same bank account needs to be mapped with the NPCI system, ensuring that all transactions can be accurately directed through the APBS. This dual-linking process is essential for the job card holder to receive wages and other government subsidies directly into their bank account, thus promoting financial inclusion and streamlining the distribution of funds to the beneficiaries in a secure and efficient manner. Additionally, this system reduces manual errors and delays commonly associated with traditional payment methods.

By adopting the APBS, the government can track disbursements more effectively, while beneficiaries gain faster access to their entitlements, enhancing the overall efficiency of welfare programs.

What is NPCI mapper?

The NPCI Mapper is a centralized repository of Aadhaar numbers managed by the Aadhaar Payment Bridge System (APBS), primarily used to route Aadhaar-based payment (APB) transactions to the respective destination banks. It serves as a critical infrastructure for linking Aadhaar numbers to the financial institutions where individuals have registered their Aadhaar details. The NPCI Mapper not only stores the Aadhaar numbers but also includes the Institution Identification Number (IIN) of the bank where the customer’s Aadhaar is seeded.

For successful Aadhaar-enabled payments and transfers, banks must regularly update this repository. This process involves uploading the Aadhaar number of customers into the NPCI Mapper in a prescribed file format, which is done via the NACH (National Automated Clearing House) portal. Banks are required to follow specific protocols and file formats to ensure data accuracy and prevent discrepancies in the transaction process. Maintaining an up-to-date record in the NPCI Mapper is essential for seamless payment processing and ensuring that subsidies, government benefits, and other Aadhaar-linked transactions reach the correct beneficiary’s account without delays or errors.

Additionally, the NPCI Mapper plays a significant role in the Direct Benefit Transfer (DBT) scheme, ensuring that government welfare payments reach the intended recipients directly through their linked bank accounts. As more banks and institutions participate in Aadhaar-based payments, the accuracy and timely updates in the NPCI Mapper have become critical for the efficient functioning of India’s financial inclusion efforts.

How the Aadhaar Payment Bridge (APB) System works?

Requirements for Aadhaar-based bridge payment system

To seed a bank account with Aadhaar and map it to the NPCI mapper, you need to provide your KYC (Know Your Customer) details, which include biometric authentication (such as fingerprint or iris scan) and demographic verification (such as name, address, and date of birth). This process ensures that your Aadhaar is correctly linked with the bank account. Additionally, any discrepancies between the information in the Aadhaar database and the bank’s records, such as mismatches in name or other personal details, must be resolved. If there are inconsistencies between the Aadhaar details, the bank account information, and the NREGA Job Card, it could lead to complications in wage disbursement. Specifically, any mismatch may result in payment delays, with wages potentially getting stuck in the system until the inconsistencies are corrected. Therefore, it is crucial to ensure that the details across all documents are consistent to avoid interruptions in receiving payments, particularly under government schemes like NREGA.

Latest updates

Govt notifies 3-10% hike in MGNREGA wage rates for FY25

On March 29, 2024, the government announced an increase in MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) wages, ranging from 3% to 10% for the financial year 2024-25, which spans from April 1, 2024, to March 31, 2025. According to a notification issued by the Centre on March 28, 2024, these revised rates will take effect from April 1, 2024, and remain valid through the end of the financial year. The wage hike this year mirrors last year’s increase, which ranged between 2% and 10%.

The average daily wage increase under the MGNREGA scheme for 2024-25 is approximately ₹28. As a result, the average daily wage will rise to ₹289 from ₹261 in the previous financial year (2023-24). The variation in wage increases depends on the state, with some regions seeing a larger percentage hike due to differing inflationary pressures and cost-of-living adjustments. These wages are determined based on changes in the Consumer Price Index for Agricultural Labor (CPI-AL), which measures inflation in rural areas, ensuring that wages reflect the rising costs of living faced by agricultural laborers and rural workers.

This wage adjustment underlines the government’s efforts to mitigate the impact of inflation on rural households and support livelihood security for millions of rural workers across India. However, critics argue that the wage increases may still fall short of meeting the actual cost of living, particularly in light of rising inflation and food prices. Nevertheless, the government has reiterated its commitment to reviewing and adjusting wages annually to reflect economic conditions in rural areas.

MNREGA wage list FY25

| Name of state/Union territory | Wage rate per day for FY25 |

| Andhra Pradesh | Rs 300 |

| Arunachal Pradesh | Rs 234 |

| Assam | Rs 249 |

| Bihar | Rs 245 |

| Chhattisgarh | Rs 244 |

| Goa | Rs 356 |

| Gujarat | Rs 280 |

| Haryana | Rs 374 |

| Himachal Pradesh | Non-scheduled areas – Rs 236Scheduled areas – Rs 295 |

| Jammu and Kashmir | Rs 259 |

| Ladakh | Rs 259 |

| Jharkhand | Rs 245 |

| Karnataka | Rs 349 |

| Kerala | Rs 346 |

| Madhya Pradesh | Rs 243 |

| Maharashtra | Rs 297 |

| Manipur | Rs 272 |

| Meghalaya | Rs 254 |

| Mizoram | Rs 266 |

| Nagaland | Rs 234 |

| Odisha | Rs 254 |

| Punjab | Rs 322 |

| Rajasthan | Rs 266 |

| SikkimSikkim(Three Gram Panchayats named Gnathang, Lachung and Lachen | Rs 249 Rs 374 |

| Tamil Nadu | Rs 319 |

| Telangana | Rs 300 |

| Tripura | Rs 242 |

| Uttar Pradesh | Rs 237 |

| Uttarakhand | Rs 237 |

| West Bengal | Rs 250 |

| Andaman and Nicobar | Andaman District – Rs 329Nicobar District – Rs 347 |

| Dadra and Nagar Haveli and Daman and Diu | Rs 324 |

| Lakshadweep | Rs 315 |

| Puducherry | Rs 319 |

No NREGA workers denied wage due to Aadhaar-based payment system: Govt

On August 2, 2023, the Ministry of Rural Development clarified that no worker under the Mahatma Gandhi National Rural Employment Guarantee Scheme (NREGS) was denied wage payments due to the implementation of the Aadhaar-based payment system (ABPS).

The ministry emphasized that the adoption of ABPS was aimed at ensuring timely and accurate wage disbursement to beneficiaries. The system was introduced to address recurring challenges, such as the frequent changes in bank account numbers by beneficiaries and delays caused by the non-updation of these changes by program officers. With the ABPS, such disruptions are minimized, as payments are directly linked to the beneficiaries’ Aadhaar numbers, making them unaffected by changes in bank accounts.

Additionally, the ministry highlighted that the use of the ABPS serves another crucial purpose: to guarantee that only genuine beneficiaries receive the benefits of the scheme. The Aadhaar linkage helps in eliminating duplications and fraudulent claims, thus maintaining the integrity of the NREGS. “The Aadhaar-Based Payment System is the most effective solution to ensure that the benefits of the scheme reach the rightful individuals,” the ministry added.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University.