How to check NREGA payment?

On March 28, 2024, the government issued a notification regarding the revised wage rates under its flagship scheme, the National Rural Employment Guarantee Act (NREGA), for the financial year 2024-25 (FY25). These updated wage rates took effect on April 1, 2024, and will remain in force until March 31, 2025. The revision is part of the government’s ongoing efforts to support rural employment and ensure that wages under NREGA align with inflationary trends and cost-of-living adjustments.

The wage hike is expected to impact millions of rural workers across the country, enhancing their livelihoods and contributing to the overall goal of reducing rural poverty. Furthermore, the new wages aim to provide increased financial stability to households dependent on seasonal and agricultural labor, making NREGA an essential safety net during times of economic uncertainty. This move is also anticipated to support local economies by increasing purchasing power in rural areas.

State-wise NREGA wage list 2024

With effect from April 1, 2024

| Name of state/Union territory | Wage rate per day for FY25 |

| Andhra Pradesh | Rs 300 |

| Arunachal Pradesh | Rs 234 |

| Assam | Rs 249 |

| Bihar | Rs 245 |

| Chhattisgarh | Rs 244 |

| Goa | Rs 356 |

| Gujarat | Rs 280 |

| Haryana | Rs 374 |

| Himachal Pradesh | Non-scheduled areas – Rs 236Scheduled areas – Rs 295 |

| Jammu and Kashmir | Rs 259 |

| Ladakh | Rs 259 |

| Jharkhand | Rs 245 |

| Karnataka | Rs 349 |

| Kerala | Rs 346 |

| Madhya Pradesh | Rs 243 |

| Maharashtra | Rs 297 |

| Manipur | Rs 272 |

| Meghalaya | Rs 254 |

| Mizoram | Rs 266 |

| Nagaland | Rs 234 |

| Odisha | Rs 254 |

| Punjab | Rs 322 |

| Rajasthan | Rs 266 |

| SikkimSikkim(Three Gram Panchayats named Gnathang, Lachung and Lachen | Rs 249 Rs 374 |

| Tamil Nadu | Rs 319 |

| Telangana | Rs 300 |

| Tripura | Rs 242 |

| Uttar Pradesh | Rs 237 |

| Uttarakhand | Rs 237 |

| West Bengal | Rs 250 |

| Andaman and Nicobar | Andaman District – Rs 329Nicobar District – Rs 347 |

| Dadra and Nagar Haveli and Daman and Diu | Rs 324 |

| Lakshadweep | Rs 315 |

| Puducherry | Rs 319 |

How to check NREGA payment in 2024?

Step 1: First, click **here** to directly access the official website for MGNREGA job cards. Once you are on the website, navigate to the homepage and look for the “Generate Reports” option in the menu. This option is crucial as it allows you to access detailed information about job cards, work allocation, and employment status under the MGNREGA scheme. After locating the “Generate Reports” section, click on it to proceed to the next step where you will be able to customize your search and view reports specific to your district, panchayat, or individual job card details.

Step 2: From the dropdown menu, select your state from a comprehensive list featuring the names of all the states and union territories in India. This list includes well-known regions such as Maharashtra, Uttar Pradesh, and Tamil Nadu, as well as smaller states like Sikkim and Goa, ensuring complete coverage of every state and territory in the country. Scroll through the alphabetically arranged options or use the search function for quicker access. Accurate state selection is crucial as it helps tailor the available options to your location, ensuring a more personalized experience based on your region’s specific guidelines and services.

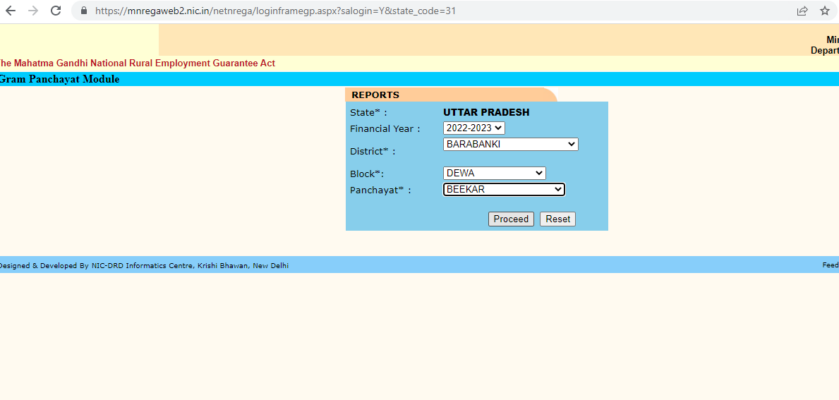

Step 3: On the following page, you will be prompted to choose the relevant details for your search. Begin by selecting the financial year from the available options. Next, choose the district, followed by the specific block and panchayat you wish to access information for. Once all fields are accurately filled in, click the ‘Proceed’ button to move forward. This will take you to the results or the next step of the process, allowing you to review or take action based on the selected data. Ensure that the details entered are correct to avoid delays or errors in the subsequent steps.

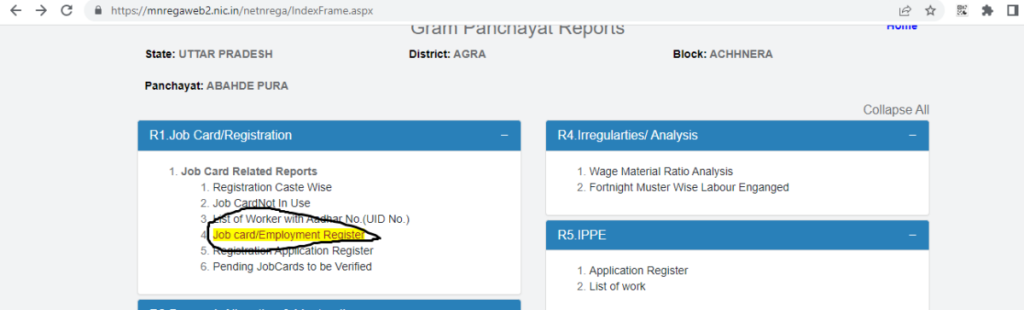

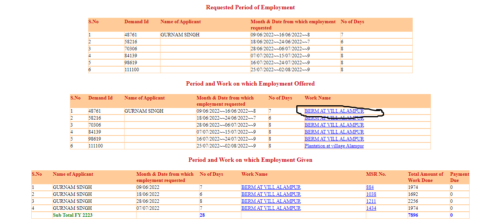

Step 4: On the following page, navigate to the ‘R1 Job Card/Registration’ tab. From the dropdown menu, choose the ‘Job Card/Employment Register’ option. This option allows you to access and manage records related to job card issuance and employment registration. Ensure that you have entered all necessary details correctly before proceeding, as this section is crucial for tracking employment history and status. Once selected, the system will display relevant data associated with job cards and employment, enabling you to review, update, or register new information as required.

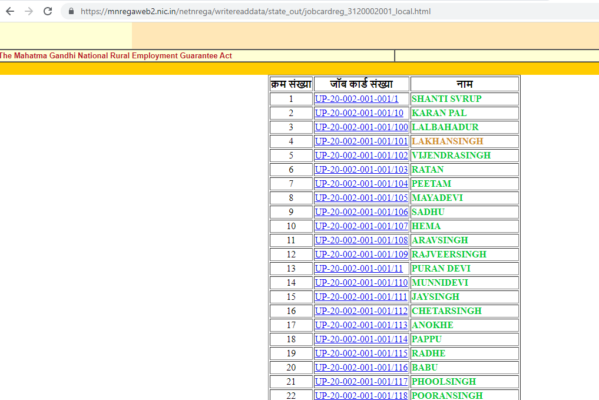

Step 5: Once the list of NREGA workers is displayed on the screen, locate the relevant NREGA job cards. To access the details of a specific worker, simply click on the corresponding MGNREGA job card number. This will open up a detailed view of the job card, where you can review key information such as the worker’s name, the duration of employment, work assigned, wages paid, and the status of ongoing or completed projects. Additionally, the job card may also provide insights into attendance records, days worked, and other important data that help ensure transparency and accountability in the MGNREGA scheme. Make sure to carefully verify all details for accuracy and completeness.

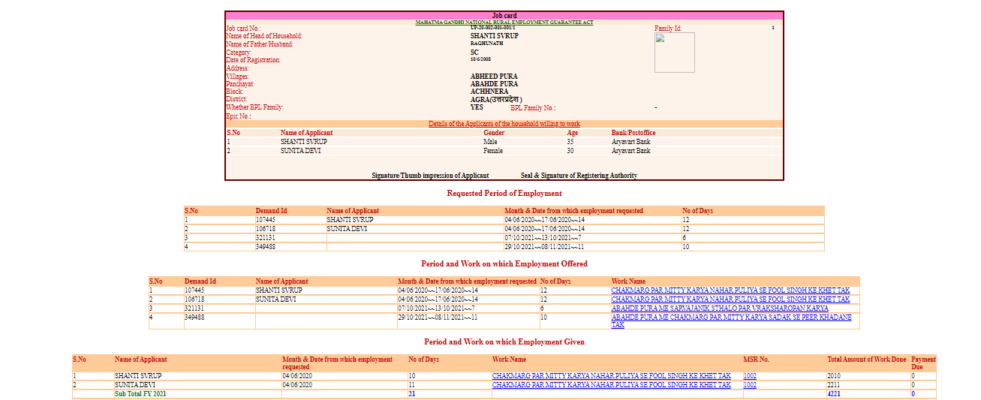

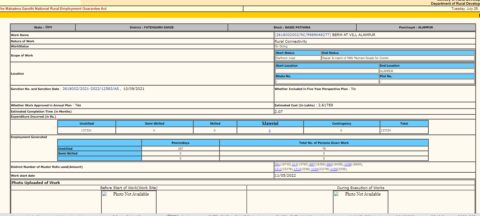

Step 6: Once you reach this step, the MGNREGA job card will be displayed on your screen. This card contains all the essential details about your employment under the scheme. On this page, you will be able to view not only the job card but also a comprehensive record of the work assigned to you, including the duration, wages earned, and the status of any ongoing tasks. Additionally, you can find information on the projects you have been involved in, the number of days worked, and any pending payments. If needed, this page also provides options to download or print your job card for future reference.

Step 7: Next, locate and click on the specific task or project for which you want to review the payment details. This will take you to a detailed summary of that particular work, where you can access comprehensive information regarding payments. You should be able to view essential data such as the total amount paid, pending payments (if any), payment method, and date of transaction. Be sure to double-check the status of each payment to ensure there are no discrepancies. If any issues arise, this page will also likely provide options for further actions, such as disputing a payment or contacting support.

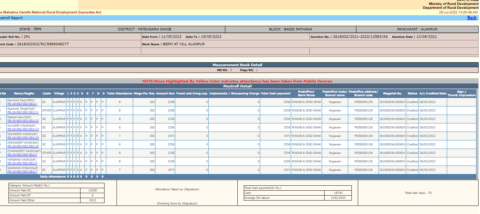

Step 8: A new page will open. Look for the section titled “Muster Rolls Used.” Here, you will find a list of available muster rolls. Click on the number displayed next to the corresponding option to view the details of that specific muster roll. This will provide further information regarding the individuals listed, their roles, and dates of service. Be sure to carefully review the muster roll for any relevant details or cross-references that might help in your search. If needed, you can return to the previous page to explore additional rolls.

Step 7: Select the specific task or project for which you’d like to view payment details.

Once you’re in the dashboard or payment section, locate and click on the work or project you’re interested in. This may be displayed as a list of tasks, assignments, or projects, depending on the platform you’re using. After selecting the correct item, the system will typically redirect you to a detailed view of payment information related to that particular work. Here, you should be able to see the amount paid, payment status (whether it is pending, processed, or completed), date of payment, and any other relevant financial details. If needed, you can also check for additional options, such as downloading invoices, payment receipts, or viewing tax details. Make sure all payment records are correct and up to date.

Step 8: At this stage, all the relevant payment details will appear on your screen. You will be able to view the transaction amount, payment date, name of the bank, and any associated transaction IDs or reference numbers. Additionally, information such as the payment method (credit card, bank transfer, etc.) and the current status of the payment—whether it is pending, completed, or failed—will also be clearly displayed. Please ensure that all the information is correct before proceeding. If there are any discrepancies, contact customer support immediately for assistance.

How NREGA payment is made?

All payments to NREGA (National Rural Employment Guarantee Act) beneficiaries are processed through the Aadhaar-based Payment System (ABPS). The ABPS is a streamlined, secure payment mechanism that uses the Aadhaar number as the primary identifier to electronically transfer government subsidies and benefits into the Aadhaar-Enabled Bank Accounts (AEBA) of eligible individuals. This system ensures that payments are directly deposited into the beneficiaries’ accounts, minimizing fraud and ensuring transparency in disbursement.

To avail themselves of ABPS, NREGA job cardholders must link their bank account with their Aadhaar number. In addition, the bank account must be mapped with the National Payments Corporation of India (NPCI) mapper, which is a database maintained specifically for routing Aadhaar-based payments to the appropriate banks. The NPCI mapper contains crucial information such as the beneficiary’s Aadhaar number and the Institution Identification Number (IIN) of the bank where the Aadhaar has been seeded. Banks are required to upload this Aadhaar-linked data into the NPCI mapper in a specified format via the NACH (National Automated Clearing House) portal, ensuring the smooth transfer of funds.

The latest update on NREGA job cards highlights that the government continues to emphasize the importance of Aadhaar integration to streamline payments. Recent efforts have been made to further strengthen the ABPS process to reduce delays in payment, resolve discrepancies in Aadhaar seeding, and improve the overall efficiency of fund disbursement under the NREGA scheme. Beneficiaries are encouraged to verify that their Aadhaar is properly linked and their details are updated to avoid any interruptions in receiving payments. Additionally, the government is expanding digital literacy efforts to help rural beneficiaries navigate the Aadhaar linking and payment tracking processes more easily, thereby enhancing financial inclusion.

Daily wages paid under MGNREGA not adequate: Parliamentary panel

On February 8, 2024, the Parliamentary Standing Committee on Rural Development and Panchayati Raj strongly recommended an urgent revision of wage rates under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS). The committee emphasized the need for the government to examine the potential for revising both the base year and the base rate used to calculate MGNREGA wages, as the current rates are not aligned with the prevailing economic conditions.

The committee highlighted significant wage disparities across different states, with rates as low as Rs 221 in Madhya Pradesh and Chhattisgarh, Rs 224 in Arunachal Pradesh, and Rs 228 in Bihar and Jharkhand. In contrast, workers in three gram panchayats of Sikkim (Gnathang, Lachung, and Lachen) receive Rs 354, while Nicobar offers Rs 328 and Andaman Rs 311. These variations underscore the need for a more equitable wage structure across regions.

The committee further observed that, when comparing wage levels since 2008, the current MGNREGA wages have not kept pace with the increasing cost of living. It noted that agricultural laborers and those engaged in masonry or other miscellaneous work now earn daily wages significantly higher than those provided under MGNREGA. This disparity, the committee suggested, could be a contributing factor to the shortage of workers participating in the scheme. The panel emphasized that addressing wage insufficiency is crucial to ensuring the scheme remains attractive and beneficial for rural laborers, especially as inflation continues to erode real income. It urged the government to act swiftly to prevent further worker exodus from the program and to enhance the scheme’s ability to support rural livelihoods effectively.

Govt makes ABPS mandatory for NREGA payments from Sept 1: Reports

On August 25, 2023, it was reported that the government has mandated the use of the Aadhaar-based Payment System (ABPS) for disbursing wages to workers enrolled under the National Rural Employment Guarantee Act (NREGA). According to sources cited in the media, this new regulation will take effect from September 1, 2023. With this deadline fast approaching, state governments are left with only a limited window to fully implement the ABPS infrastructure. The pressure to expedite the process is high, as official data from the NREGA website reveals that a significant portion of active workers, approximately 19.4% or 2.77 crore individuals, are still not linked to the ABPS. This gap presents challenges for ensuring seamless wage disbursement, raising concerns about potential delays and disruptions in payments to these workers if the system isn’t updated in time. State governments now face an urgent task of completing the linkage process to avoid bottlenecks in payments, which could affect the livelihood of millions dependent on timely wages under NREGA.

Additionally, various labor and social groups have raised concerns about the practicality of enforcing the ABPS on such short notice, particularly in remote areas where Aadhaar-related infrastructure is still being developed. They argue that workers without access to the necessary resources or those facing technical issues with Aadhaar verification may encounter delays in receiving their wages. Furthermore, states are being urged to streamline the integration process while addressing the logistical hurdles and ensuring that no worker is left out due to administrative inefficiencies.

FAQs

What is the frequency of NREGA wage payment?

According to Section 3(3) of the MGNREGA, workers are entitled to payment on a weekly basis. This payment must not be delayed beyond a fortnight from the day on which work was done.

What if NREGA payment is delayed?

In case of a delay in payment of wages, a NREGA worker has the right to receive payment of compensation for the delay at the rate of 0.05% of the unpaid wages per day beyond the 16th day of closure of muster roll.

What is unemployment allowance under the NREGA?

If an applicant is not provided employment within 15 days of receipt of his application seeking employment, he must be provided an unemployment allowance.

Who is responsible for the payment of the unemployment allowance?

As per Section 7(3) of the MGNREGA, state government is liable to pay unemployment allowance to the household concerned.

How are NREGA wages calculated?

NREGA wages are set by the Central government and varies from state to state. The wage rate is subject to periodic revision. Wages are supposed to be paid according to the quantity and quality of work performed, usually measured in standard ‘person days’ of work.

What are the modes of NREGA payment?

Payments are made directly to the bank or post office accounts of the workers to ensure transparency and reduce the risk of fraud.

What can I do if I don’t receive my payment on time?

Beneficiaries should first check with their local NREGA functionaries at the village or panchayat level. If the issue is not resolved, they can escalate it to higher officials like the block development officer or the district magistrate. Complaints can also be lodged through the NREGA portal or helpline.

How can I check my NREGA payment status?

You can check your payment status online through the official NREGA website by entering your job card number or other relevant details.

What documents are needed for NREGA payment processing?

A worker needs to have a valid job card, a bank or post office account linked with Aadhar and NREGA Job Card number, and entries of work done in the official records.

What if the NREGA payment is delayed?

The worker has the right to receive payment of compensation for the delay at the rate of 0.05% of the unpaid wages per day beyond the 16 days of closure of muster roll.

What details need to be provided on the NREGA pay slip?

Individual pay slips or wage slips should have the details of wage payments like work ID, wage rate, number of days worked, amount earned by the worker during the week, number of mandays completed per HH and number of man-days of employment due to the households concerned etc.

Who decides regarding opening of account in post office/bank?

The choice among different service providers (commercial/scheduled banks/ RRBs/post offices/ mobile banks) is left to the decision of the wage seekers as per their convenience.

Is there any authentic document required to open the NREGA wage seeker account?

The MGNREGA Job Card duly signed by the officer concerned is an officially valid document for opening a bank account under the Know Your Customer (KYC) norms.

Who is responsible for issuing NREGA job cards?

Gram panchayats are responsible for issuing NREGA job cards.

Can I apply online to get work under NREGA?

A job seeker has to apply in writing for getting employment under the law.

Can a person apply for a job card in villages where they are not a local domicile?

No, a person can’t apply for a job card in villages where they are not a local domicile.

What will happen if a Job Card is lent to others who do not have a Job Card?

A person who is not registered is not entitled to work and get payment. If a Job card is lent to another person, he will work and get paid in your name, even though the job card holder did not work, which is illegal.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University.